Nvidia Corp., looking to cement its place at the heart of the artificial intelligence boom, laid out plans for more powerful chips, an AI model for robotics, and “personal AI supercomputers” that will let developers work on desktop machines.

Speaking at the company’s annual GTC event in San Jose, CEO Jensen Huang unveiled a platform called Isaac GROOT N1 that will “supercharge humanoid robot development.” Nvidia is working with Walt Disney Co. and Google’s DeepMind on the project, which will be open to outside developers.

Dell Technologies Inc., HP Inc. and other manufacturers, meanwhile, will make the new personal supercomputer systems. Huang also introduced a successor to Nvidia’s flagship AI processor called the Blackwell Ultra. That chip line, due in the second half of 2025, will be followed by a more dramatic upgrade called “Vera Rubin” in the latter half of 2026.

The GTC conference, once a little-known gathering of developers, has become a closely watched event since Nvidia took a central role in AI — with the tech world and Wall Street taking its cues from the presentation.

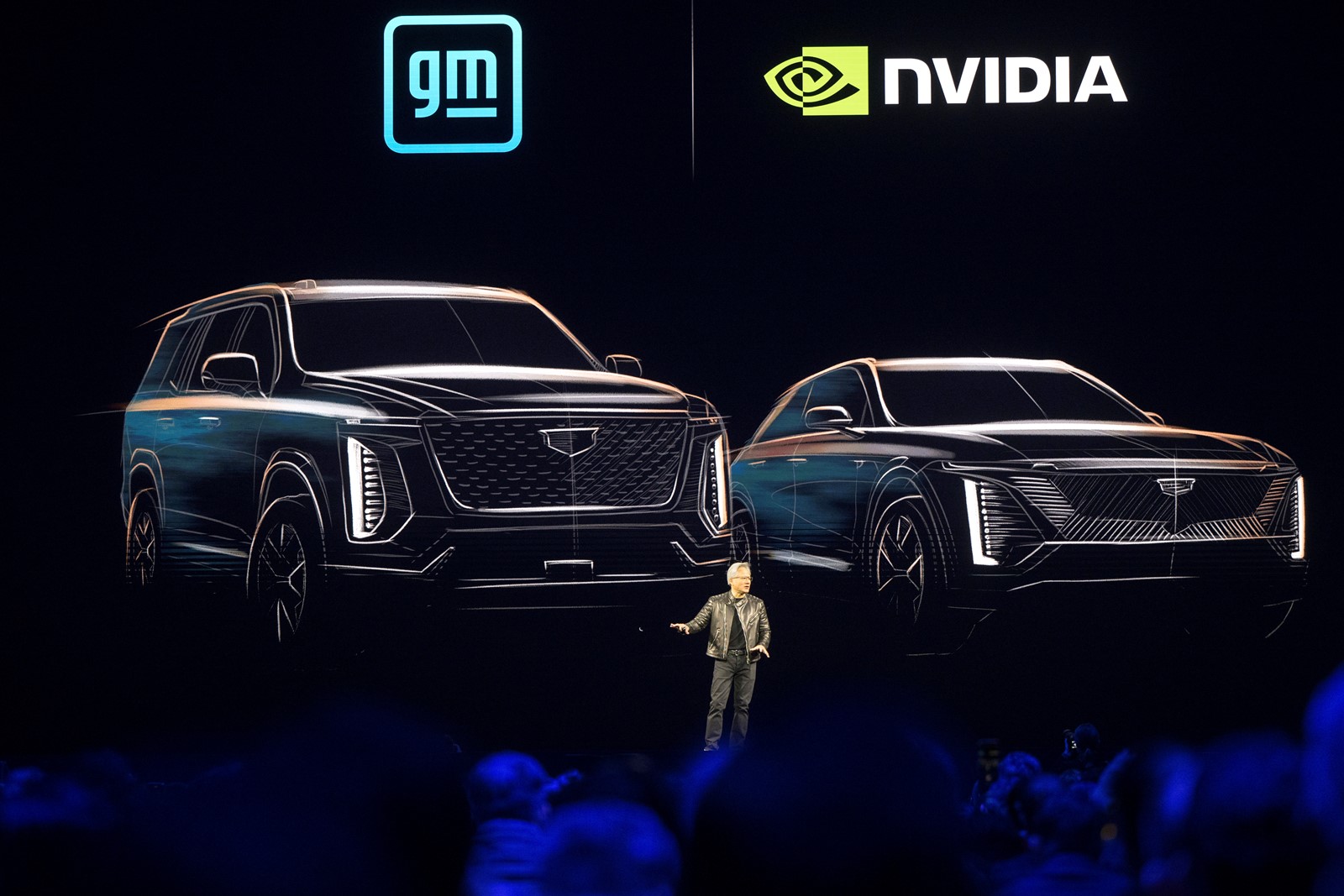

During the speech, Huang said Nvidia was working with General Motors Co. to use AI in next-generation cars, factories and robots. He also unveiled a separate wireless project involving companies such as T-Mobile US Inc. and Cisco Systems Inc. Nvidia will help create “AI-native” wireless network hardware for new 6G networks, the successor to today’s 5G.

It’s a pivotal moment for Nvidia. After two years of stratospheric growth for both its revenue and market value, investors in 2025 have begun to question whether the frenzy is sustainable. These concerns were brought into focus earlier this year when Chinese startup DeepSeek said it had developed a competitive AI model using a fraction of the resources.

DeepSeek’s claim spurred doubts over whether the pace of investment in AI computing infrastructure was warranted. But it was followed by commitments by Nvidia’s biggest customers, a group that includes Microsoft Corp. and Amazon.com Inc.’s AWS, to keep spending this year.

The biggest data center operators — a group known as hyperscalers — are projected to spend $371 billion on AI facilities and computing resources in 2025, a 44% increase from the year prior, according to a Bloomberg Intelligence report published Monday. That amount is set to climb to $525 billion by 2032, growing at a faster clip than analysts expected before the viral success of DeepSeek.

But broader concerns about trade wars and a possible recession have weighed on Nvidia’s stock, which is down 14% this year. The shares fell 2.9% to $116.02 in New York trading Tuesday.

Huang offered a road map for future chips and unveiled a breakthrough system that relies on a combination of silicon and photonics — light waves.

Nvidia has suffered some production snags as it works to rapidly upgrade its chips. Some early versions of Blackwell required fixes, delaying the release. Nvidia has said that those challenges are behind it, but the company still doesn’t have enough supply to meet demand.

Huang said the top four public cloud vendors — Amazon, Microsoft, Alphabet’s Google and Oracle — bought 1.3 million of Nvidia’s older-generation Hopper AI chips last year. So far in 2025, the same group has bought 3.6 million Blackwell AI chips, he said.

After Vera Rubin debuts in the second half of next year, Nvidia plans to release a version a year later called Rubin Ultra.

PREVIOUS ARTICLE

PREVIOUS ARTICLE