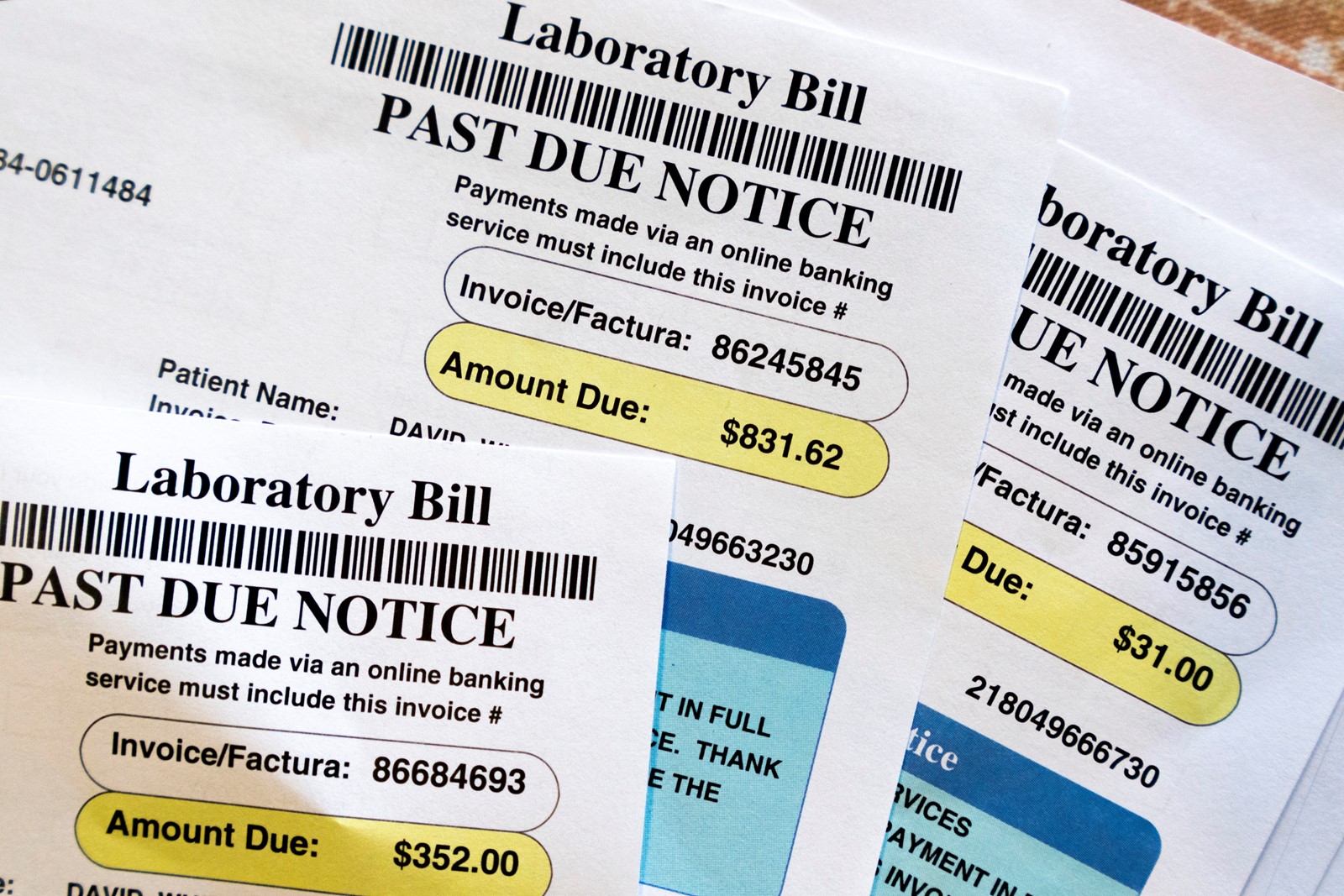

A federal judge in Texas removed a Joe Biden-era finalized rule by the Consumer Financial Protection Bureau that would have removed medical debt from credit reports.

U.S. District Court Judge Sean Jordan of Texas’s Eastern District, who was appointed by President Donald Trump, found that the rule exceeded the CFPB’s authority.

Jordan said that the CFPB is not permitted to remove medical debt from credit reports according to the Fair Credit Reporting Act, which protects information collected by consumer reporting agencies.

Removing medical debt from consumer credit reports was expected to increase the credit scores of millions of families by an average of 20 points, the bureau said. The CFPB states that its research has shown outstanding health care claims to be a poor predictor of an individual’s ability to repay a loan, yet they are often used to deny mortgage applications.

The three national credit reporting agencies — Experian, Equifax and TransUnion — announced last year that they would remove medical collections under $500 from U.S. consumer credit reports. The CFPB’s rule was projected to ban all outstanding medical bills from appearing on credit reports and prohibit lenders from using the information.

The CFPB estimated the rule would have removed $49 billion in medical debt from the credit reports of 15 million Americans.

Settlement reached Zuckerberg lawsuit

A settlement was announced Thursday in court in a class action investors’ lawsuit against Meta CEO Mark Zuckerberg and current and former company leaders over claims stemming from the privacy scandal involving the Cambridge Analytica political consulting company.

The suit had sought billions of dollars in reimbursement for fines and legal costs. No details on the settlement were shared when it was announced in Delaware’s Court of Chancery at the start of what would have been the second day of trial, at which point nothing related to the settlement had been filed with the court.

The attorneys involved left court without commenting. A communications representative from Meta said the company had no comment.

Investors had alleged in the lawsuit that Meta did not fully disclose the risks to Facebook users that their personal information would be misused by Cambridge Analytica, a company that supported Donald Trump’s successful Republican presidential campaign in 2016. Shareholders say Facebook officials repeatedly violated a 2012 consent order with the Federal Trade Commission under which Facebook agreed to stop collecting and sharing personal data without users’ consent.

canadian company drops 7-Eleven bid

After a year of prolonged negotiations marked by dramatic twists and turns, Canadian retailer Alimentation Couche-Tard said it was abandoning its multibillion-dollar bid to acquire the owner of 7-Eleven convenience stores.

The company, which operates Circle K convenience stores, wrote to 7-Eleven owner Seven i Holdings that it was withdrawing its proposal because of a lack of “sincere or constructive engagement” that would allow the deal to progress. It accused the Japan-based Seven i of a “calculated campaign of obfuscation and delay.”

Seven i said in a statement that it would accept Couche-Tard’s decision, though it found the announcement “regrettable.” It also defended its actions, saying the Couche-Tard letter contained “numerous inaccurate statements” and that its special committee had engaged in “sincere and constructive discussions.”

clean energy taking a hit under trump

U.S. annual clean-energy installations will plunge 41% after 2027, due to the rapid phase-out of wind and solar tax credits in President Donald Trump’s sweeping economic legislation.

Deployments will fall to 48 gigawatts in 2028 when wind and solar projects will lose eligibility for the tax incentives, according to a report Thursday from BloombergNEF. That’s compared to 81 gigawatts the prior year as developers race to complete projects before the cutoff date.

While renewables are often the cheapest source of electricity, the forecast underscores the reliance clean energy still has on subsidies. Eliminating federal incentives threatens to upend the U.S. energy industry by hampering the roll out of wind and solar, which have become the biggest sources of new electricity generation.

Compiled from Associated Press and Bloomberg reports.

PREVIOUS ARTICLE

PREVIOUS ARTICLE