Iran is racing to get its oil out into the world, a sign of the unusual logistical steps that Tehran is undertaking as the U.S. mulls joining Israel in bombing the Persian Gulf state.

Oil is gushing out of the nation’s ports and onto ocean-tankers, ensuring revenues would continue — at least for a while — if shipments are disrupted. Despite the surge, storage tanks at the nation’s critical export terminal at Kharg Island are brimming with crude.

Traders and investors are parsing every piece of data available to understand how oil from the Islamic Republic and the wider Gulf region will be affected as Israel pounds the country’s nuclear sites, military and wider energy infrastructure. Satellite data offer at least part of the answer when it comes to Iran.

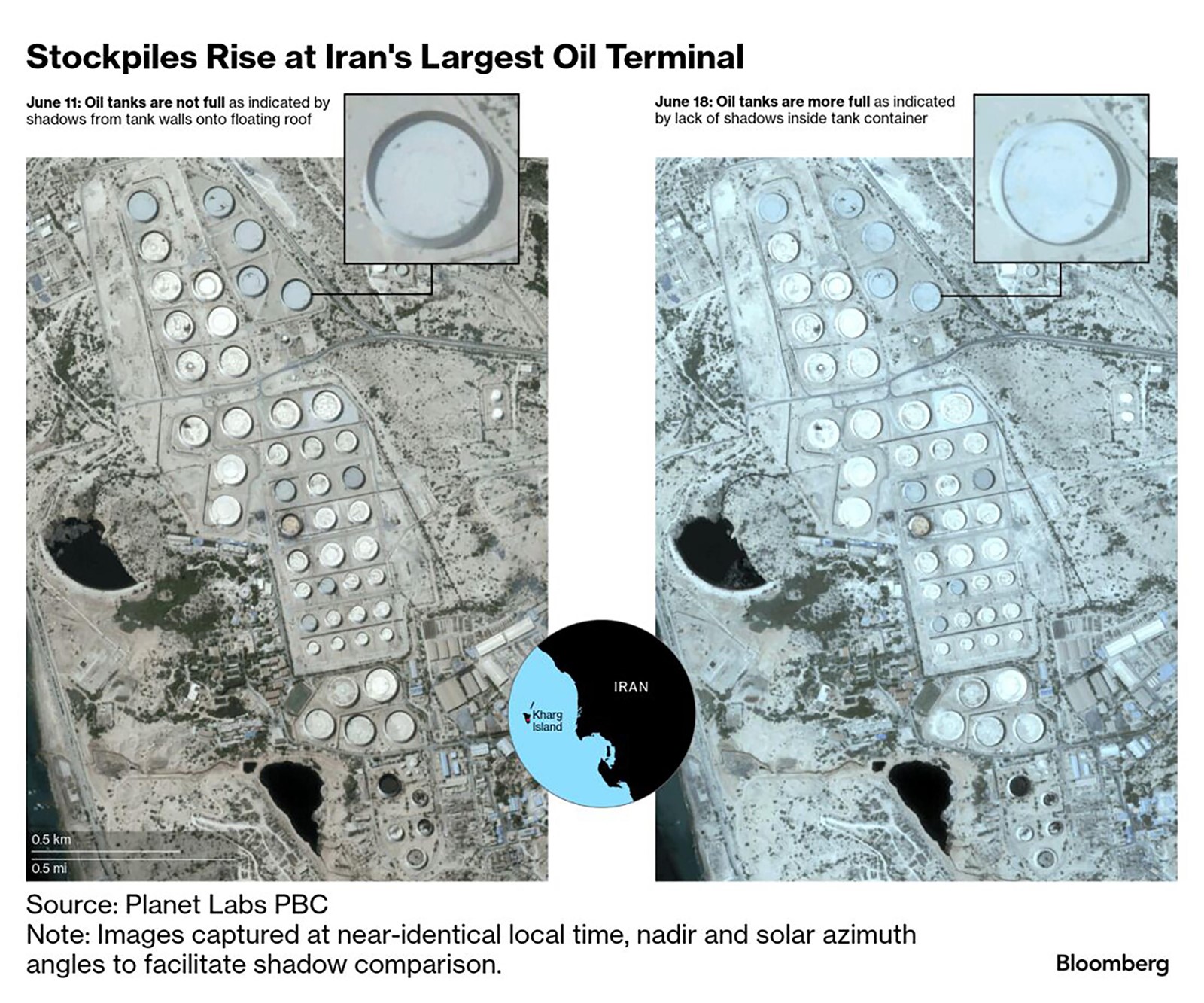

The oil storage sites at Kharg Island have floating roofs that rise and fall as they empty and fill, meaning it’s possible to get clues from above as to just how much they’re holding by examining their shadows. And what images from June 11 show is that, for almost all of the large tanks, the roofs were well below the top of the walls. In short, the reservoirs were only partly full.

Fast forward by a week, and a photo from Wednesday, several days after Israel began its attacks, shows there are no such shadows, indicating that the roofs are now at the top of the walls and the reservoirs are brimming. There are still shadows cast by the tanks onto the ground beside them, confirming that the absence isn’t due to a lack of sunshine. The images were taken less than 10 minutes apart about 2:40 pm local time on their respective days with nearly the same sensor geometry.

Samir Madani, co-founder of TankerTrackers.com a firm that specializes in monitoring the clandestine oil trade of Iran and other nations using satellite imagery, confirmed that he also saw “ a rise in crude inventories at the island.”

That’s not what you’d expect, given that Iran has been driving up its exports.

If the exports are well above normal, then storage tanks should be emptying — unless Iran is also directing even more crude into the facility. The inference, then, is that Iran is sending as much as possible to the global market while it can.

Iran can store about 28 million barrels of crude at Kharg, according to a 2024 report from S&P Global Commodity Insights. Refurbishment of two 1 million barrel tanks was completed last month, but it’s unclear whether they were included in the earlier capacity figure.

Iran’s oil exports have spiked since the nation came under attack from Israel on June 13, according to Madani.

It exported an average of 2.33 million barrels a day in the five days the attacks began, according to data from TankerTrackers.com. That’s an increase of 44% compared with the average for the year through to Saturday.

“It seems very clear what they’re doing,” Madani said of Iran’s approach. “They’re trying to get out as many barrels they can but with safety as their number one priority.”

Oil is held in closely packed storage tanks at Kharg, making it more vulnerable to attack than cargoes on ships dotted around the Persian Gulf or heading for China.

In another sign of Tehran’s logistical response, vessels are staying far away from Kharg until the last possible moment before dashing to the terminal to load and spending as little time as possible at the terminal.

PREVIOUS ARTICLE

PREVIOUS ARTICLE