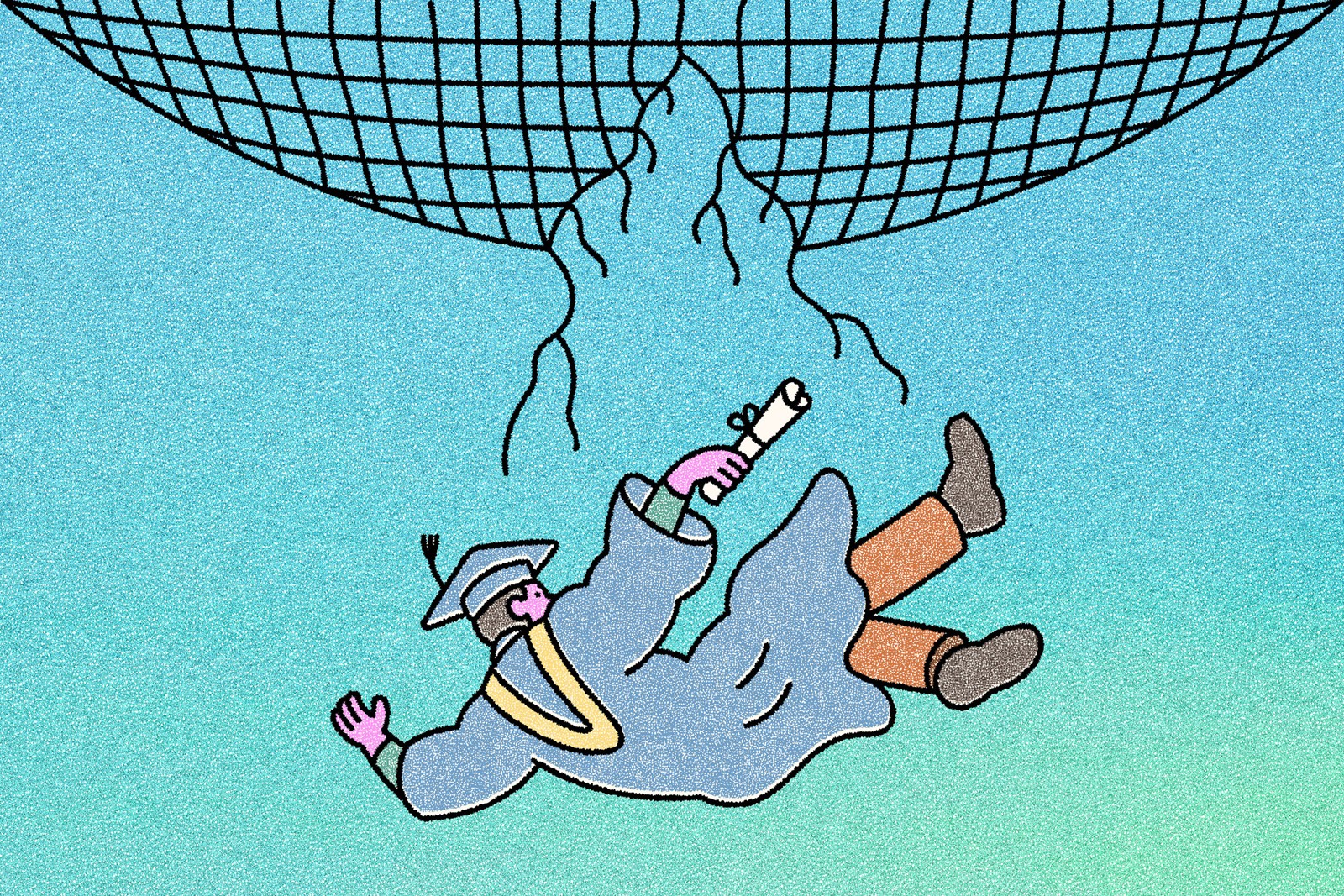

The safety net for federal student loan borrowers is about to be sharply overhauled.

The domestic policy bill that was signed into law recently makes radical changes to the way Americans will pay for college, and could make access to higher education more difficult. It will also fundamentally alter the way borrowers repay their debts, which can easily spiral into tens of thousands of dollars, sometimes more.

Starting next summer, borrowers taking out fresh loans will have two new repayment plans to choose from, while at least a half-dozen existing programs will be extinguished, including the most affordable option, the Biden-era plan known as SAVE. The nearly 8 million people in that plan will soon need to figure out their next-best option.

The system is being restructured at a crucial moment in the ongoing student loan saga. Only 44% of the nearly 35 million borrowers who should be making payments actually are, according to calculations by Mark Kantrowitz, an expert on student loans. And nearly 6 million borrowers were reported to the credit bureaus as being late at the end of April, according to TransUnion, sending their credit scores plunging.

Further complicating the situation, the overhaul will begin not long after the Education Department’s staff has been cut in half as part of the Trump administration’s slashing of the federal bureaucracy.

Here’s a look at the new options for new and existing borrowers.

How do new plans work?

All borrowers who take out loans on or after July 1 next summer will have access only to the two new plans.

First, there’s a refashioned standard repayment program. Under this plan, fixed payments are made over a term based on the loan amount — the larger the loan, the longer the term — typically ranging from 10 years for people with less than $25,000 in loans to 25 years for those with more than $100,000.

The second option is called the Repayment Assistance Program, known as RAP. It is philosophically similar to existing income-driven repayment (IDR) plans, which tie payment size to income levels and household size, but there are some major structural differences. RAP’s payments range from 1% to 10% of the borrower’s adjusted gross income over a term up to 30 years, at which point any remaining debt will be forgiven. That’s five to 10 years longer than existing IDR plans, and would result in more people paying back a greater share of their loans.

“The message RAP sends is this Congress wants borrowers to pay their loans back in full, and they want the federal loan system dramatically scaled back,” said Travis Hornsby, a financial planner who consults with borrowers about repayment strategies.

RAP has some attractive features: If your monthly payment amount doesn’t cover the interest owed, the interest will be erased. There’s also a guarantee that your loan’s principal — the amount you borrowed — will fall by $50 a month. If your payment chips away at only $20 of the principal, for example, the federal government kicks in an additional $30, said Jessica Thompson, a senior vice president at the Institute for College Access & Success, a research and advocacy group.

But a significant bug could make this plan more expensive over time: RAP is not indexed for inflation, so a borrower whose income merely kept pace with inflation could be bumped into higher payment tiers.

Overall, some borrowers will initially have lower payments under RAP, while others will pay more, but outcomes will vary according to their circumstances. (The Education Department should eventually update its loan simulator to help borrowers compare the plans.) Some single borrowers will come out ahead under the RAP plan compared with existing IDR plans (excluding SAVE), according to an analysis at the Urban Institute, but payments are higher for those earning above $80,000 or below $30,000.

Unlike existing IDR programs, the RAP plan will require even people with no income to make a token $10 payment, which borrower advocates worry could throw some of the most distressed borrowers into default.

“We are about to make student loan servicers, who are already overwhelmed, chase down people you know have no money and collect $10 from them,” said Mike Pierce, executive director of the Student Borrower Protection Center. “When you don’t have any money, even $10 is a lot.”

There are other drawbacks, including a potential marriage penalty that can be harsher than in existing plans. In some cases, RAP can double a couple’s payment, with their combined income catapulting them into a higher income band, according to an analysis by Kristin Blagg, a principal research associate at the Urban Institute. Couples can choose to file separate federal income tax returns, but that may come at the expense of other tax benefits attached to filing jointly.

What are existing borrowers’ options?

If you’re in a standard repayment plan, you can stay there, provided you don’t take out any new loans, loan experts said.

And if you’re in one of the income-driven repayment plans slated for closure — SAVE, as well as Pay as You Earn (PAYE) and Income-Contingent Repayment (ICR), will shut down by June 30, 2028 — you will be able to move into the new RAP plan. But you will also maintain access to at least one existing income-driven plan, Income-Based Repayment, if that works best.

There is a caveat: You cannot take any new loans on or after next July 1. If you do, you will be able to use only the new RAP and standard repayment plans, advocates for borrowers said.

That means that existing IDR enrollees will need to figure out which works in their favor: Income-Based Repayment or RAP? Under IBR, borrowers pay 10% of their discretionary income toward their balance for 20 years — and any remaining balance is forgiven. (That formula applies to borrowers with loans made after July 1, 2014. For loans taken before that, borrowers pay 15% of income over 25 years.)

“RAP tends to have a lower monthly payment for low- and moderate-income borrowers,” Kantrowitz said. But it has a longer repayment term before any debt forgiveness occurs, so borrowers may pay more over the life of the loan, unless they qualify for the Public Service Loan Forgiveness program, which wipes out debt for eligible nonprofit and government workers after 120 qualifying payments.

“You really have to model it for your specific situation,” he added.

What if I have Parent PLUS loans?

Parents who take new loans on or after July 1, 2026, will have one option: the new standard repayment plan. They aren’t eligible for RAP.

Can I still use forbearance?

People who hit a rough patch — a job loss or another economic hardship — will still be able to pause their payments, but they have fewer options. The new law eliminates economic hardship and unemployment deferments for loans made on or after July 1, 2027.

Borrowers in financial distress will generally need to turn to forbearance, which will let them stop payments for up to nine consecutive months over a two-year period.

The idea is to steer cash-constrained borrowers into longer-term options like the RAP program.

PREVIOUS ARTICLE

PREVIOUS ARTICLE