REAL ESTATE

New apartment starts beginning to trend downAs apartment builders churn out a record number of new rental units, the industry is bracing for declines next year.

“We are delivering more new multifamily units than at any time since the 1970s,” with about 400,000 U.S. apartments added this year, said John S. Sebree, senior vice president with commercial property firm Marcus & Millichap. “In 2024, the number of units we are going to deliver is a 41% increase over the six-year average.”

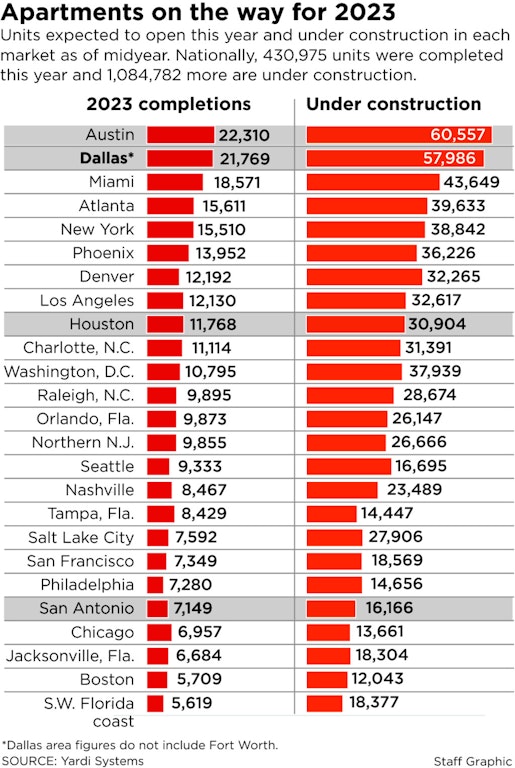

The Dallas-Fort Worth area is at the top of the list with an estimated 26,000 units opening their doors this year, Sebree said. “There is going to be a little bit of softness over the next couple of years as we deliver these units.”

Construction of thousands of new apartments in Texas’ other major metro areas is already causing a decline in rents in some markets.

“You guys like to build,” Sebree said at an apartment forecast conference this week in Dallas sponsored by Marcus & Millichap and Institutional Property Advisors.

“Vacancies are going to be going up,” he said. “But none of these markets really cause a lot of concern long term.”

D-FW and Texas markets lead the country in job growth and population increases, which fuel demand for apartments.

“The fundamentals of Texas are rock solid,” Sebree said.

Thanks to higher interest rates and a more challenging debt market, apartment construction is already trending down in the D-FW area and across the country.

Only 39,000 apartments were started nationwide in the third quarter.

“That’s a 75% decrease in new starts” from last year’s peak, Sebree said. “The fourth quarter is going to drop further and the first quarter of next year is going to drop even more.”

The dramatic slowdown in project starts is causing analysts and builders to predict a shortage of rental units in three or four years.

“We are going to hit a point in a few years where occupancies are going to increase and that rent growth is really going to kick in,” Sebree said. “A lot of units are coming online over the next two years. Once you get to 2025, it’s going to drop.”

North Texas has been the country’s top apartment building market for several years thanks to the region’s strong job and population growth.

The D-FW area added over 178,000 jobs in the year ending in September. And North Texas’ population grew by 170,000 people last year.

All of that growth fuels demand for rental units at the same time high mortgage rates make it harder for people to buy homes.

More than 72,000 apartments were being built in D-FW at the end of September — the most of any U.S. market.

Statewide, 175,000 apartments are on the way, said Carl Whitaker, a real estate economist with Richardson-based RealPage.

“We are actually a little bit off the peak we saw last year of 200,000” apartments being built in Texas, Whitaker said. “Construction is starting to ease a little bit. The number of units being started today is down 40% to 50% in most of the major markets in Texas.”

Even so, almost 27,000 new apartments are opening in D-FW this year. And an estimated 44,000 rental units will be added to the market in 2024 and 2025.

Net apartment leasing in D-FW totaled 7,247 units in the most recent quarter — the best of any U.S. market, according to RealPage. But that fell short of the 8,170 apartments completed in the same period.

Average rents in D-FW were up only about 1% year-over-year in the third quarter — not enough to keep up with inflation.

Whitaker said 2024 will be tough, with 2025 starting to look better.

Builders are hoping the downturn in starts and rent increases won’t last long.

“We all believe there is going to be a supply gap because starts are slowing down,” said Matt Brendel, senior managing director with developer Legacy Partners. “If we hit that supply gap rent growth starts taking off again. There is still a need for supply — especially in Texas.”

While apartment construction in D-FW is starting to wane, Brendel said he isn’t seeing a softening in construction costs.

“We haven’t seen any relief yet,” he said. “I think [contractors] think there is still a large pipeline. I think they will be negatively surprised within the next six months.”

Apartment brokers are hoping to see a rebound in sales next year with more distressed properties hitting the market. Investors are already gearing up to make buys.

More than $6.8 billion in D-FW apartments were sold in the first nine months of 2023 — the most of any U.S. market. But sales this year are down from 2022 when over $20 billion in North Texas apartments traded.

“The amount of pension fund money sitting on the sidelines right now is enormous,” Sebree said. “The amount of private capital sitting on the sidelines is also near an all-time high. Everybody is waiting to see how this new construction goes through the market.”

Financial firm Goldman Sachs — which is building a huge new regional office center just north of downtown Dallas — expects to make apartment purchases in the next year.

“We will be raising an opportunistic fund sometime in the next 12 to 18 months,” said Katie Bloom, a Goldman Sachs managing director. “We have been a big seller of real estate in the last two years. I think we will turn around and buy next year. “

Goldman Sachs is eyeing recently built luxury apartment properties in Dallas’ urban districts, Bloom said.

Southlake-based Trinity Investors, which has a $6.5 billion real estate portfolio, plans to stick with the multifamily market, managing director Dan Meader said.

“I have no concern about multifamily as an investment class,” Meader said. “We are not going to be a seller any time soon. The high net-worth investor market continues to see real estate as an alternative to fixed-income securities.”

But some apartment owners with billions of dollars of lower interest debt coming due in the next year may have no choice but to sell. Finding money for new multifamily starts is a challenge.

“It’s expensive and it’s really difficult to put debt on these projects,” said Spencer Schlee, managing director with Canyon Partners, which shifted operations from California to a new Dallas office two years ago. “This dynamic is really slowing down the construction pipeline.”